SEPERATION OF OWNERSHIP AND CONTROL IN PUBLIC COMPANIES AND CORPORATION

1. INTRODUCTION

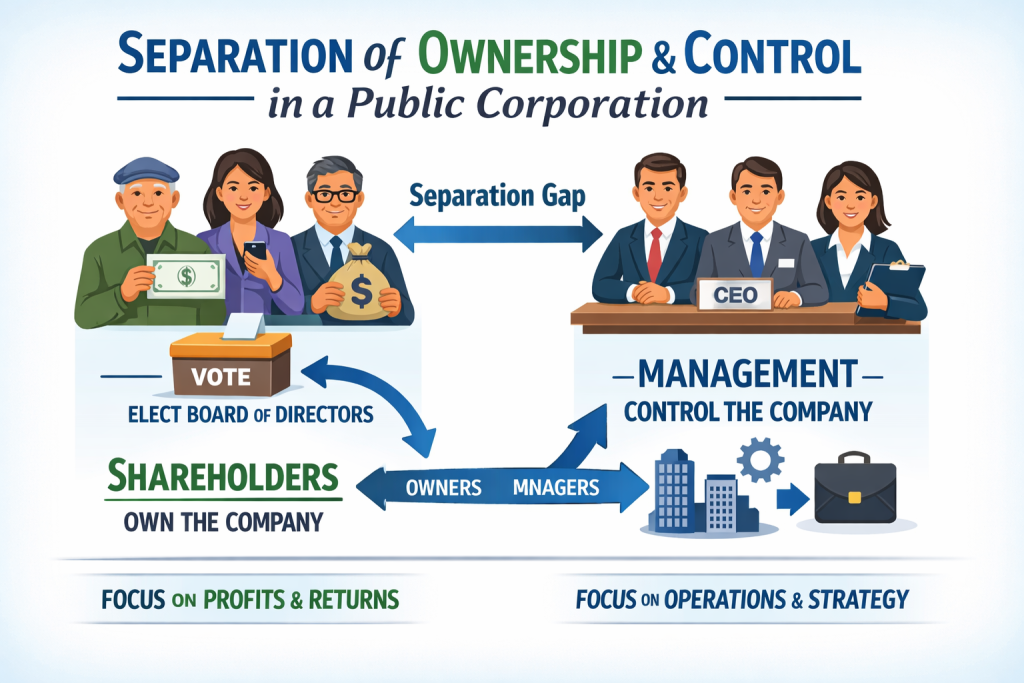

The concept of separation of ownership and control remains central to modern corporate governance discourse. While shareholders are the legal owners of a company, control and day-to-day management are typically vested in directors and executive management.

In Nigeria, this relationship is now principally governed by the Companies and Allied Matters Act 2020 (CAMA 2020), which repealed the 1990/2004 framework and introduced significant corporate governance reforms, including:

- Enhanced minority shareholder protection

- Mandatory disclosure obligations

- Recognition of single-member companies

- Derivative actions

- Independent directors in public companies

Section 87 of CAMA 2020 provides that a company acts through:

- Its members in general meeting, or

- Its board of directors

Thus, although shareholders are the ultimate owners, management authority is delegated to the board.

The separation becomes more pronounced in large public companies where ownership is widely dispersed among numerous shareholders.

2. THEORETICAL FOUNDATION

The classical theory of separation of ownership and control was developed by:

- Adolf Berle

- Gardiner Means

In their seminal work The Modern Corporation and Private Property (1932), they demonstrated that in large corporations, shareholders are too dispersed to exercise effective control, leaving managers with substantial discretionary power.

This phenomenon gave rise to what economists call the agency problem — where managers (agents) may pursue personal interests rather than shareholders’ (principals’) interests.

3. CURRENT STRUCTURE OF OWNERSHIP AND CONTROL IN NIGERIA

A. Private Companies

In most Nigerian private companies:

- Shareholders are few

- Ownership and management are usually fused

- Directors are often family members or major shareholders

CAMA 2020 now allows single-member companies, reinforcing ownership-control fusion in small enterprises.

Agency problems are minimal but conflicts may arise among family shareholders.

B. Public Companies (Listed)

Public companies listed on the Nigerian Exchange Limited (NGX) demonstrate clearer separation.

Features include:

- Dispersed shareholders

- Professional managers

- Independent non-executive directors

- Audit and governance committees

However, shareholders typically lack sufficient information and coordination to effectively monitor management.

This creates risks of:

- Earnings manipulation

- Insider abuse

- Excessive executive compensation

- Related-party transactions

C. Government-Owned Corporations

Examples include:

- Nigerian National Petroleum Company Limited

- Central Bank of Nigeria

- Nigerian Communications Commission

Under the Petroleum Industry Act 2021, NNPC was transformed into a limited liability company (NNPC Ltd), introducing corporate governance structures similar to private companies, although government remains the sole shareholder.

Here, ownership resides in the Federal Government, but control is exercised through appointed boards — raising concerns about political influence and managerial independence.

4. CURRENT PROBLEMS OF SEPARATION OF OWNERSHIP AND CONTROL

(1) Agency Costs

Managers may:

- Pursue empire building

- Manipulate financial statements

- Engage in wasteful expenditures

Recent global examples include:

- The collapse of FTX (2022)

- Governance failures at Credit Suisse (2023 crisis and takeover)

These cases highlight weak internal controls and ineffective board oversight.

(2) Weak Shareholder Activism in Nigeria

Unlike in developed markets, Nigerian shareholders rarely:

- Challenge board decisions

- Initiate derivative actions

- Vote against management proposals

Though CAMA 2020 introduced derivative action rights, usage remains limited.

(3) Concentrated Ownership

In many Nigerian public companies, majority shareholders dominate decisions, leading to:

- Minority oppression

- Related-party transactions

- Board capture

(4) Regulatory Enforcement Gaps

Regulatory bodies include:

- Securities and Exchange Commission Nigeria

- Financial Reporting Council of Nigeria

Although governance codes exist, enforcement challenges persist due to:

- Delayed prosecutions

- Political interference

- Weak compliance culture

5. MODERN CONTROL MECHANISMS

To address ownership-control separation, Nigeria now relies on:

(1) Nigerian Code of Corporate Governance (2018)

Issued by the Financial Reporting Council, it mandates:

- Board independence

- Separation of CEO and Chairman roles

- Whistleblowing frameworks

- Risk management systems

(2) Independent Directors

CAMA 2020 mandates independent directors in public companies to reduce managerial dominance.

(3) Audit Committees

Audit committees now include shareholder representatives, strengthening financial oversight.

(4) Disclosure & Transparency

Public companies must:

- Publish annual reports

- Disclose related-party transactions

- Comply with International Financial Reporting Standards (IFRS)

(5) Market Discipline

Stock market reactions, takeovers, and reputational consequences serve as indirect control mechanisms.

6. EMERGING TRENDS (2024–2026)

Recent developments influencing ownership and control include:

- ESG (Environmental, Social, Governance) accountability

- Digital shareholder meetings

- Increased institutional investor activism

- FinTech governance reforms

- Stricter anti-money laundering compliance

The transformation of NNPC under the Petroleum Industry Act is particularly significant in aligning state-owned enterprises with private-sector governance standards.

7. CONCLUSION

The separation of ownership and control is inevitable in modern corporations, particularly in public companies with dispersed shareholding.

While it promotes:

- Professional management

- Efficient capital mobilization

- Corporate growth

It also generates:

- Agency problems

- Managerial opportunism

- Minority shareholder vulnerability

Nigeria’s response — particularly through CAMA 2020 and the Nigerian Code of Corporate Governance — reflects a shift toward stronger accountability and transparency.

However, effective enforcement and shareholder activism remain critical to ensuring that control is exercised in the interest of ownership.